The Greatest Guide To Estate Planning Attorney

Wiki Article

6 Simple Techniques For Estate Planning Attorney

Table of ContentsThe Facts About Estate Planning Attorney UncoveredThe Estate Planning Attorney DiariesEstate Planning Attorney Can Be Fun For EveryoneEverything about Estate Planning Attorney

Estate planning is an activity plan you can use to establish what happens to your possessions and responsibilities while you're alive and after you die. A will, on the various other hand, is a lawful file that lays out how possessions are distributed, who looks after youngsters and pet dogs, and any type of various other dreams after you pass away.

Insurance claims that are turned down by the administrator can be taken to court where a probate judge will have the last say as to whether or not the insurance claim is legitimate.

The Ultimate Guide To Estate Planning Attorney

After the supply of the estate has actually been taken, the value of properties computed, and taxes and financial debt settled, the administrator will certainly after that look for consent from the court to disperse whatever is left of the estate to the beneficiaries. Any type of estate tax obligations that are pending will come due within 9 months of the date of fatality.

Each private places their assets in the depend on and names somebody aside from their partner as the recipient. Nonetheless, A-B depends on have ended up being less popular as the estate tax exception functions well for the majority of estates. Grandparents might transfer assets to an entity, such as a 529 strategy, to support grandchildrens' education.

Unknown Facts About Estate Planning Attorney

This technique includes cold the worth of a property at its worth on the date of transfer. Accordingly, the quantity of potential Resources resources gain at fatality is additionally iced up, enabling the estate organizer to estimate their possible tax responsibility upon death and better prepare for the repayment of earnings tax obligations.If enough insurance proceeds are offered and the plans are properly structured, any kind of revenue tax on the considered personalities of possessions following the death of a person can be paid without considering the sale of assets. Profits from life insurance policy that are gotten by the recipients upon the fatality of the guaranteed are normally earnings tax-free.

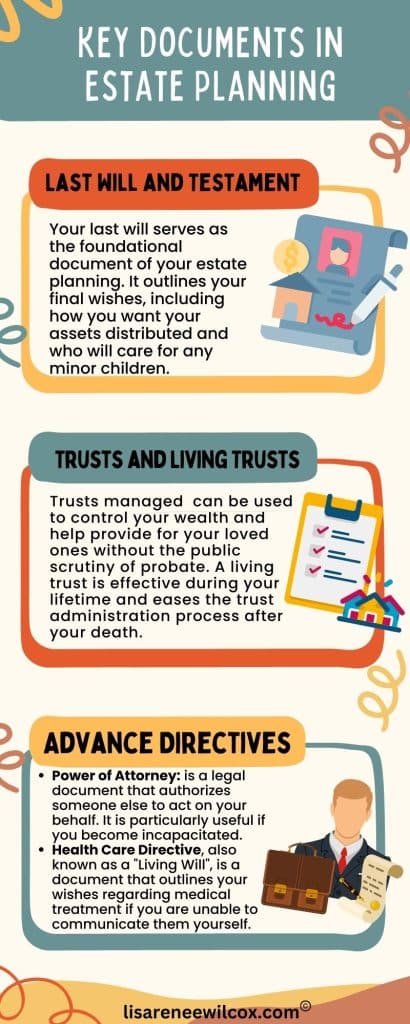

There are particular documents you'll require as component of the estate planning process. Some of the most common ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate planning is just for high-net-worth individuals. That's not true. Estate planning is a tool that everybody can utilize. Estate preparing makes it much easier for individuals to establish their dreams prior to and after they die. Unlike what the majority of people think, it prolongs beyond what to do with properties and liabilities.

What Does Estate Planning Attorney Do?

You need to begin preparing for your estate as quickly as you have any kind of quantifiable possession base. It's a recurring procedure: as life proceeds, your estate plan must change to match your situations, in line with your new objectives. And keep at it. Not doing your estate planning can create excessive financial problems to loved ones.Estate preparation is typically assumed of as a device for the wealthy. Estate preparation is additionally a terrific means for you to lay out strategies for the treatment of click over here now your small youngsters and family pets and to describe your desires for your funeral and preferred charities.

Eligible candidates that pass the test will certainly be officially certified in August. If you're eligible to rest for the exam from a previous application, you may submit the short application.

Report this wiki page